31 May is the deadline for paying property taxes

Since the second half of April, the Financial Administration (FS) has sent payment information to over 4 million taxpayers to pay property tax by 31 May. If the tax in a region exceeds CZK 5,000, it can be paid in two installments, the second by 30 November. If someone has not received the payment information via postal order, data box, or e-mail by Friday 24 May and does not pay the tax via SIPO, the advice is to contact the competent tax office or to access the ‘tax information’ section on the MY FISCAL Portal . There every taxpayer is able to find payment information including a QR code to easily pay via mobile phone.

Using the MY Tax portal to find payment information, including a QR code, is very simple. After opening the portal site, simply go to the tax data box and use your e-banking or data box login data or a chip ID card for identification. Most citizens choose verification by bank identity, which is already used by more than 4 million people in the country, according to the Director General of the Tax Administration Simona Hornochová.

Approximately 1.1 million databox holders received tax payment information in their mailboxes, and another 1 million registered taxpayers received the information in their mailboxes in the first half of May. Payment information was sent to other taxpayers by post in the form of a total of 1.8 million letters with a postal receipt by 24 May. All communication methods contain payment information for the transfer of money, including a QR code to make payment easy for every taxpayer.

Despite an intensive communication campaign, there is currently a large number of inquiries concerning tax increases as the tax deadline approaches. These queries are especially found in cities where, in addition to the increase in the tax rate resulting from the law, there has also been the introduction or increase of the local coefficient. Various official sources have, therefore, tried to provide the clearest and most comprehensible information on regional workplaces and telephone lines, so that people could better understand the reasons for the changes adopted and their effect on the amount of tax. Tax rates were increased by an average of 80%, but at the same time, there could also be a significant tax increase as a result of the introduction or increase of the local coefficient by the municipality. FS statistics show that a local coefficient greater than 1 is used by about 1,100 municipalities, i.e. about every 5-6 municipalities in the Czech Republic.

Property tax is determined by the total amount of all the taxpayer’s properties located in the territory of each individual region. The receipts are pre-printed with the bank account of the tax office to which the tax is paid, including the area code and bank code. It is possible to pay by cashless transfer to the tax office account, tax deposit or via SIPO. More detailed information on the payment of property tax, including the bank account numbers of the financial authorities, is also provided on the website of the tax administration.

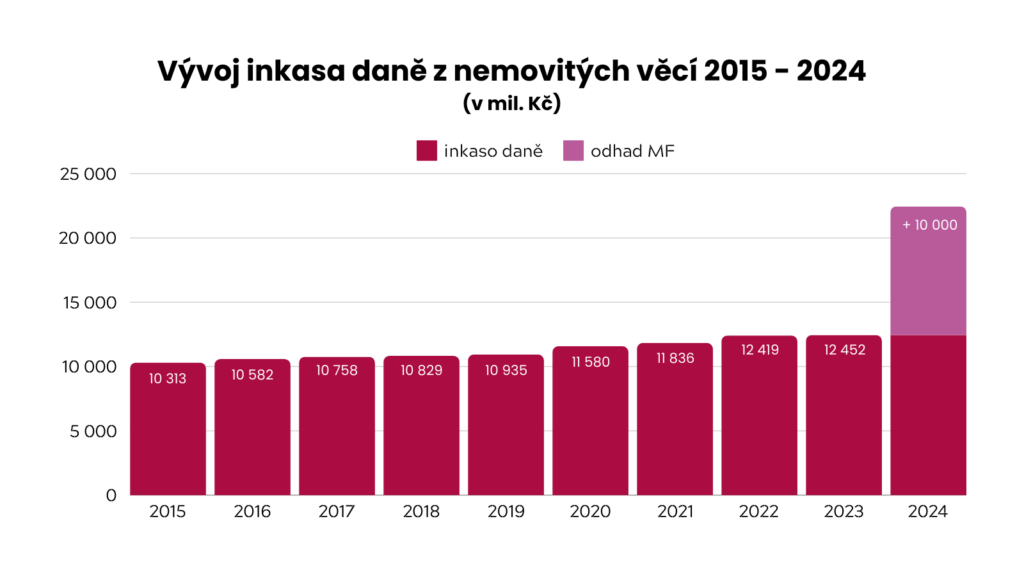

According to the assumptions of the Ministry of Finance, the total collection of property tax is expected to increase by CZK 10 billion, compared to last year’s CZK 12.45 billion.

The time frame for the collection of property taxes is, therefore, drawing to a close, accompanied by careful communication on the part of the Tax Administration. Despite the increase in local rates and coefficients, which have triggered doubts among various taxpayers, the authorities have provided ways and means to facilitate payment, anticipating a significant increase in tax revenue.

Sources: https://www.seznamzpravy.cz/