Recent developments in the Czech real estate market and trends in the housing affordability index

The revival of the real estate market in the Czech Republic

The number of transactions in the Czech domestic real estate market has been on the rise since last spring. In the final quarter of 2023, sales of new buildings almost doubled year-on-year while there was an increase of roughly 49% in the sale of older apartments. According to the Czech Banking Association experts, this rebound signifies a return to a “normal” state after the significant market downturn experienced in the second half of 2022 due to the Russia-Ukrainian war outbreak.

“Especially in the second half of 2023, the market was already much more active than in the previous four quarters. In this way, we are gradually approaching the normal behavior between supply and demand, which was here before the war and before the exaggerated boom of 2021, this is what Milan Roček, director of Dataligence, said to clarify that the activity at the end of 2023 was essentially similar to that at the end of 2020.

Moreover, price evolution must be evaluated based on the diverse developments in the individual quarters of the last two years, when prices fell mainly between the third quarter of 2022 and the second quarter of 2023 and then stagnated or slightly rose from the third quarter onward.

The recovery of the real estate market was supported by a blend of elements. In particular, the gradual rebound of the mortgage market last year is to be attributed to a combination of factors, including relaxed income indicator rules by the Czech National Bank, a slight decline in real estate prices, and a drop in mortgage rates. Jakub Seidler, the Chief Economist of the ČBA, anticipates continued revival in the mortgage market with double-digit growth throughout the year, although it may not reach pre-pandemic levels.

The gap between incomes and prices has diminished

Lately, the gap between domestic household incomes and real estate prices has narrowed thanks to a slight reduction in the latter.

In an international comparison carried out in 2022, the Czech Republic ranked among the top countries where recent real estate price growth largely surpassed household income growth. Despite the past year brought a slight correction in this regard, a large imbalance persists and the Czech Republic continues to hold the leading position in international comparisons in terms of housing unaffordability.

In the context of real estate price development in the European Union, the Czech Republic stands out as one of the leading countries in long-term growth dynamics. Over the past decade, real estate prices in the country have surged by 125%, surpassing the EU average of “only” 55%, and further increases are anticipated this year. For the coming year, Milan Roček of Dataligence anticipates a somewhat more active real estate market, but he does not expect a rapid growth. An expected modest 1% increase in real estate prices could potentially improve real estate availability, alleviating the disparity between real estate price growth and nominal household incomes.

Regarding new buildings, Seidler suggests that an uptick in demand may lead to a reduction in marketing incentives from developers, which primarily influenced the slight discounting observed in the first half of last year. For older apartments, he anticipates a trend where the prices will be influenced by new building prices, resulting in a slight increase throughout the year. Cities, in addition to the State, can contribute to housing availability by increasing rents in their own buildings or undertaking new constructions. Miroslav Žbánek, vice-chairman of the Union of Towns and Municipalities (ANO), emphasizes the importance of financial support for construction and legislative or technical changes to expedite building preparations, along with national or European subsidies.

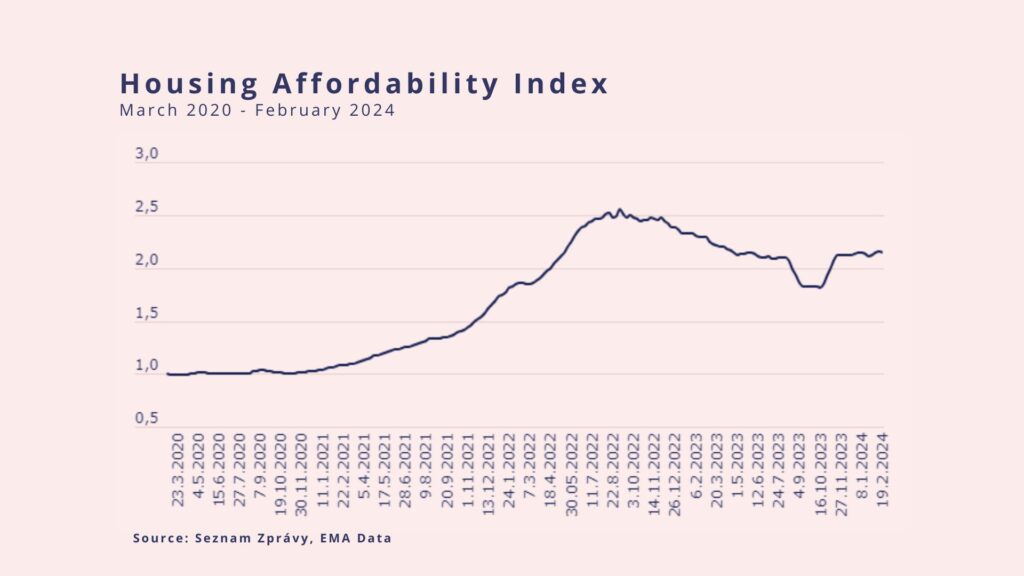

Variations in the Housing Affordability Index

The Housing Affordability Index developed from EMA Data has the aim of monitoring how the level of affordability of apartments develops in each region of the Czech Republic. The index combining average real estate prices in individual regions and mortgage loan interest rates, calculates the average price per meter for an average personal apartment, regardless of condition or material. The resulting calculation is then compared to the initial value set at level 1 in March 2020 keeping into account that the higher the value, the less affordable apartments are, and vice versa, if the value is below level 1, apartment affordability increases. Generally speaking, this index is very useful since when it is compared to the current income levels, it expresses in percentages how much of a household’s net monthly income is absorbed by the mortgage payment for an apartment at the current average price.

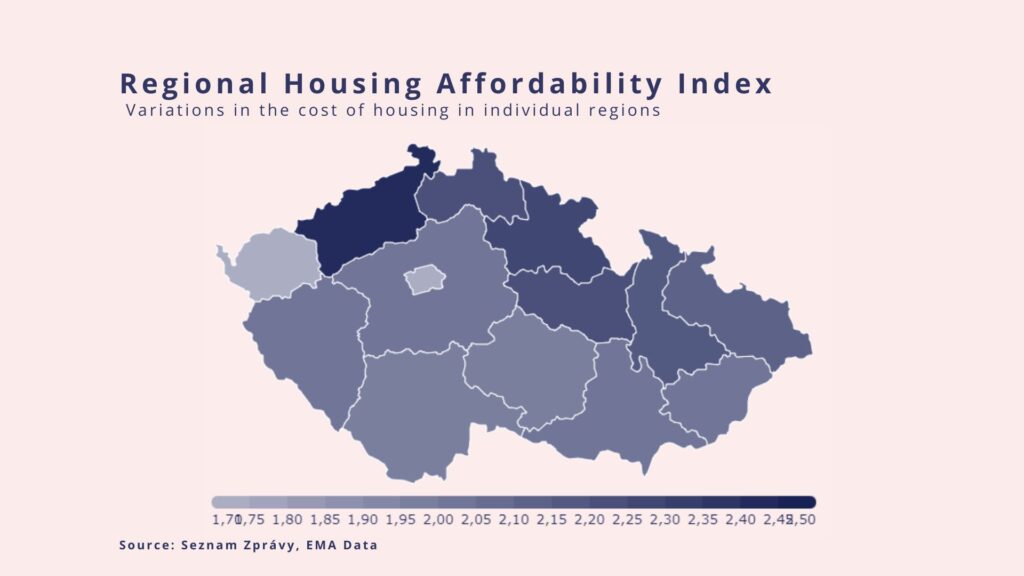

Currently, the index has an average value of 2.15 at the national level, but its regional calculation demonstrates how the affordability of apartments for a mortgage loan differs based on the region.

The index value for Prague, which is equal to 1,69, is below the value of 2 during the monitoring period, but when compared to March 2020, availability has deteriorated by approximately 71%.

In addition to Prague and the Karlovy Vary Region, Vysočina and the South Bohemian Region also stayed below the threshold of 2 while in other regions, the unaffordability of apartments is currently more than one hundred percent higher compared to March 2020.

When it comes to the amount of the average mortgage repayment, people living in Prague are the ones that generally pay the most, despite a slight reduction from 34,432 to 34,051 CZK compared to last week. Prague is followed by the South Moravian region with a current amount equal to 20,844 CZK and Central Bohemia, where apartment owners spend a bit less than 20,000 per month. On the contrary, the Ústí Region has for a long time registered the lowest average mortgage payment now reaching 9,333 crowns. Yet, this week, a reduction in mortgage payments has been experienced in all Czech regions and even the national average of monthly installments fell slightly.

Sources: https://www.seznamzpravy.cz/, https://emadata.cz/, https://www2.deloitte.com/ ,